Introduction

If you are an executor or administrator of an estate in Texas, you may be wondering what to do about debt collectors. After all, the last thing you want is for the estate to be hounded by creditors. Read on to find out more about how to deal with debt collectors in independent probate administrations in Texas.

The Probate Process in Texas

If you’re dealing with debt collectors in an independent probate administration in Texas, there are some things you should know about the probate process. First, if you’re the executor or administrator of an estate, you’re responsible for paying the debts of the deceased from the estate’s assets. That means you may have to deal with debt collectors.

Second, the independent administration of an estate gives you a lot of leeway in how you deal with creditors. You’re not required to give them preferential treatment, and you can even pay some debts with money that would otherwise go to beneficiaries.

Finally, keep in mind that the sooner you pay off debts, the less interest and penalties will accrue. So it’s in your best interest to get debts paid off as quickly as possible.

If you have any questions about dealing with debt collectors in an independent probate administration, please contact an experienced Texas probate attorney for help.

Dealing with Debt Collectors in Texas

If you are an executor or administrator of an estate in Texas, you may be contacted by debt collectors trying to collect on debts owed by the estate. While you are not personally responsible for the debts of the estate, you may need to take some action to deal with these debt collectors.

Here are some tips for dealing with debt collectors in Texas:

1. Be aware of your rights. Debt collectors must abide by certain rules and regulations when trying to collect a debt. You have the right to request information about the debt, and the collector must provide this information if requested. You also have the right to dispute the debt, and the collector must stop contacting you if you request them to do so in writing.

2. Communicate with the collector in writing. It is often best to communicate with debt collectors in writing, rather than over the phone. This way you have a record of your communications. You can use certified mail with return receipt requested so that you have proof that the collector received your letter.

3. Do not make any payments on the debt without consulting an attorney. If you make a payment on the debt, it may revive the statute of limitations and allow the collector to sue for the

Conclusion

If you are an independent probate administrator in Texas and you have debt collectors contacting you, it is important to know your rights. You can send a cease and desist letter to the debt collector telling them to stop contacting you. If the debt collector does not comply with your request, you can file a complaint with the Attorney General’s office or the Consumer Financial Protection Bureau.

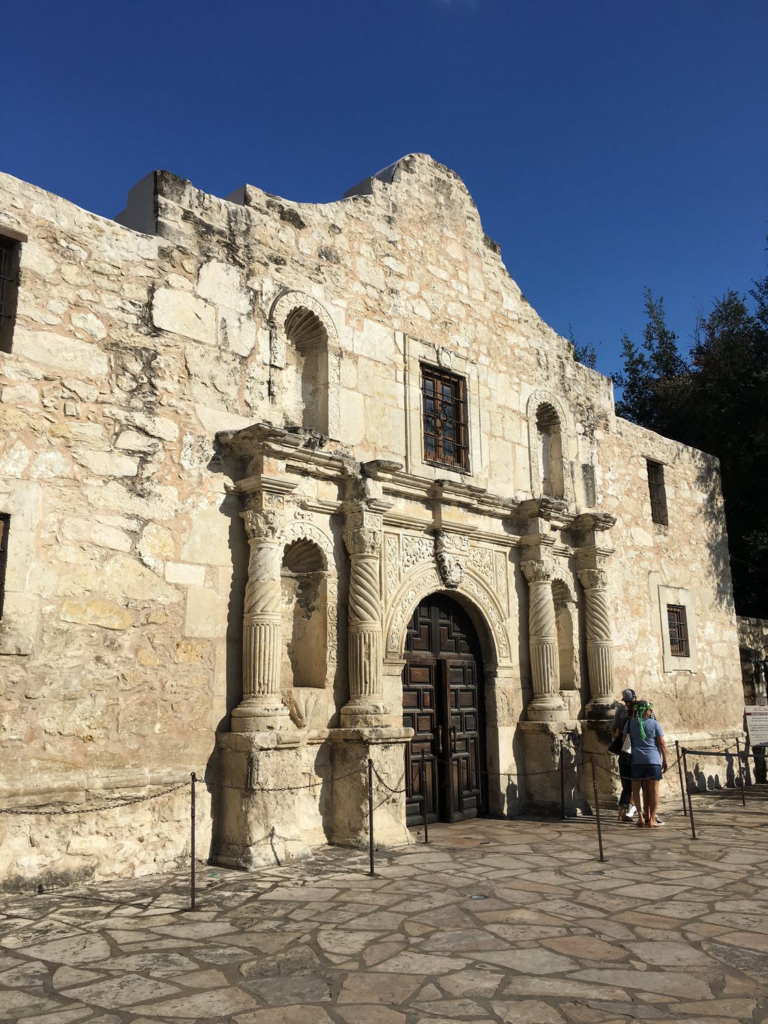

Do you need a San Antonio Attorney to File Notice to Creditors?

Do you need help with an estate planning or probate matter in San Antonio-metro area or the surrounding communities? We are experienced estate planning and probate attorneys who represent clients with sensitive estate planning and probate matters. If so, please give us a call us at 210-794-7835 or use the contact form on our homepage to see how we can help.

Related Questions

Can a creditor open probate under Texas law?

Probate is the legal process of administering the estate of a deceased person. In Texas, if the deceased person owed money to creditors, the creditors may file a claim in probate court to have the debt paid from the estate. However, there are certain requirements that must be met in order for a creditor to open probate.

First, the creditor must have written notice of the death of the debtor. Second, the creditor must file a claim with the court within four months after the date of death. Third, the creditor must file an Affidavit of Debt along with their claim. The Affidavit of Debt must state that the debt is valid and owing, and must be signed by an authorized representative of the creditor.

If these requirements are met, then the court will open probate and administer the estate according to Texas law. However, if one or more of these requirements are not met, then the court may dismiss the creditor’s claim.

How long can creditors go after an estate in Texas?

Creditors have a limited time to file claims against an estate in Texas. The time period is set by the Texas Estates Code and begins on the date of the decedent’s death. For most creditors, the deadlines is two years from the date of death. However, some creditors may have a longer or shorter time period to file a claim.

If you are an executor or administrator of an estate in Texas, it is important to be aware of the deadlines for creditors’ claims. This will help you avoid any surprises down the road and ensure that the estate is distributed according to the decedent’s wishes.

How long do creditors have to collect after death in Texas?

Creditors have a limited time to collect debts after a person dies. In Texas, creditors have two years from the date of death to file a claim against the estate. This means that if you are named as an executor or administrator in someone’s will, you may be responsible for paying off their debts after they die.

If you are dealing with debt collectors after the death of a loved one, it is important to know your rights. You do not have to deal with abusive or harassing behavior from debt collectors. You also are not required to pay more than the deceased person owed on the debt.

If you are named as an executor or administrator in a will, you should contact an experienced probate attorney to help you navigate the debt collection process. An attorney can help you understand your rights and obligations and make sure that the estate is properly administered.

What priority do creditors take in the distribution of an estate?

In Texas, creditors take priority over the distribution of an estate in independent probate administrations. This means that if there are not enough assets to pay all of the debts, the creditors will be paid first before any distribution is made to the beneficiaries. If you are a creditor of an estate in independent probate administration, it is important to file your claim as soon as possible so that you can receive payment from the estate.

Probating a Will: How to probate a will in Texas?

If you are the independent administrator of an estate in Texas, you may be wondering how to deal with debt collectors. The first thing you should do is contact the probate court in the county where the estate is being administered and request a hearing. At the hearing, the judge will appoint you as the independent administrator and will give you specific instructions on how to proceed.

Once you have been appointed as the independent administrator, you will need to provide notice to all creditors of the estate. You can do this by mailing a copy of the notice to each creditor at their last known address. The notice must include information about the date and time of the hearing, as well as your contact information.

At the hearing, you will need to present evidence that all creditors were properly notified of the hearing. Once this has been done, the judge will issue an order that allows you to collect debts owed to the estate. You will then have 90 days to collect any debts owed. After 90 days, any unpaid debts will be discharged and cannot be collected from the estate.

What happens in probate court?

Probate is the legal process of transferring the assets of a deceased person (the “decedent”) to his or her heirs. If the decedent left a will, the court appoints the executor named in the will to carry out the decedent’s wishes. If the decedent did not leave a will, the court appoints an administrator to oversee the estate. The court reviews the will to determine whether it is valid. If so, the executor or administrator files a “Petition for Probate of Will” (also called a “probate petition”), and pays the required filing fee.